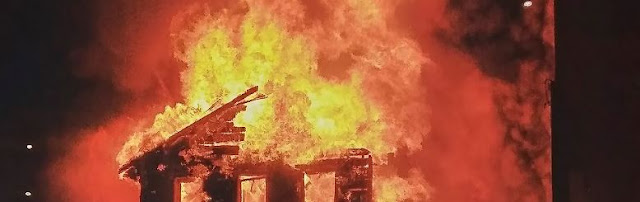

I sympathize with parts of the let it burn thesis. The thesis goes a bit like this:

Crypto is mostly gambling. It provides very little of social value, and may even be a net negative. The recent collapse of the FTX crypto exchange is illustrative of this. It would be a travesty for us to wade in after the fact and lever public resources to regulate crypto. To do so would grant undeserved credibility to the stuff. Thankfully, the collapse of FTX didn't spread into the real economy. Let's keep crypto unregulated and isolated. Leave it to die of its own accord.

Four quick push backs:

1. Crypto is not going to burn down because of FTX. We know this because it has already collapsed multiple times (2011, 2014, 2018) yet each time people come back and want to play the Dogecoin or Shiba Inu or Bitcoin games. Dozens of crypto trading venues have collapsed over the last decade due to fraud and incompetence, yet burnt customers keep coming back to the table to play.

Crypto is fun and exciting. It's here to stay. Maybe it's time to set up some guard rails.

2. Yes, crypto is mostly gambling. But we already allow all sorts of gambling activities, including sports betting, online casinos, and speculation on double-leveraged VIX ETFs. We set requirements on providers of these activities in order to protect users from fraud and wrongdoing. Let's do the same for crypto.

Start with the venues that facilitate crypto gambling: so-called "exchanges" like Kraken, Binance, Crypto.com, and Coinbase. These platforms provide both brokerage and exchange services, combining two functions that regular finance has traditionally separated. Require these crypto broker-exchanges to comply with the same basic consumer financial protections that currently apply to non-crypto brokers and exchanges. This includes segregation of customer funds, third-party custody, regular auditing, and insider trading prevention.

The idea is to let people engage in risky gambling, but to do so as safely as possible.

Canada and Japan have already taken these steps. That's why Canadians and Japanese are much less likely to be on the list of those hurt by FTX's collapse than folks in Australia and U.S., which haven't yet gone down the road to regulating crypto broker-exchanges.

3. The failure of a casino or sport-betting site is rarely systemic. Likewise, regulated crypto venues will probably never pose significant systemic risk. Even if a crypto venue were to somehow became so integral to finance that its failure would be catastrophic, we have tools for this, like designating venues as systemically important financial institutions.

4. It's possible that the value that crypto provides to society one day transcends gambling. Crypto could become a way to get a consumer loan or finance a startup. If so, better to hold a given type of crypto venue to whatever set of regulatory standards are the most appropriate, and do so now rather than later. If a crypto platform quacks like a bank, for instance, then regulate it as a bank, perhaps tailoring the rules a bit here and there to account for the peculiarities of crypto. If it quacks like a broker-dealer, then regulated it as a broker-dealer.

Mostly OK. Point 3 might get one accused of being a pollyanna, if we aren't going to regulate it, and clearly, we aren't up to the task. Casino and sports betting sites are nowhere near as linked up to the financial system so the analogy isnt quite right. Heck with letting it burn, I say actively burn it down. And take the sports betting disgrace of an industry with it.

ReplyDelete"I say actively burn it down"

DeleteBanning crypto is one option. The problem with that is then you foreclose on my point #4. That is, you prevent people from ever providing regular financial products using blockchains as databases.

Wouldn't the let-it-burn approach be a very interesting higher level experiment to see if a specific industry is capable of self-regulating?

ReplyDeleteFor this specific industry, it could be some proof of reserves standard, non custodial and/or decentralized exchanges, specific auditing standards, etc

The last ten years was an experiment in self-regulation. And the failure of FTX -- the world's second largest exchange -- was a culmination of that approach. It's a good as sign as any that the industry needs to be regulated along the same lines as regular financial entities, and quickly.

DeleteI know people that have lost money in FTX, and they are not complaining. They knew that was a risk, and they regret not having been more dilligent. Given that everything around us is hyper-regulated, I think we all tend not to be dilligent enough, so maybe we need more than 10 years (or more FTX like events) to begin to see clients demanding self-regulation.

DeleteHere an example of self regulation in Switzerland:

Deletehttps://www.vqf.ch/en/sro

I'm not sure the VQF is what you think it is:

Delete"The VQF SRO is officially recognised, regulated and supervised by FINMA, which is why this supervisory system is referred to as (legally and officially) controlled self-regulation."

It's basically another regulated institution.

To be clear, I would be fine with this sort of institutional arrangement for crypto. For instance, in Canada all broker-dealers are overseen by IIROC, a self-regulatory organization (like the VQF) that is in turn regulated by our securities commissions. We recently brought crypto exchanges under IIROC jurisdiction. That's what I meant when I said that "Canada and Japan have already taken these steps." IIROC jurisdiction over crypto exchanges is a good thing, and the US should do the same thing.

Outside of the failed efforts of a few desperate third world dictators, no country has allowed tax payment in crypto. Neither has crypto been used as a reasonable store of predictable value, or as reliable means of payment. It is not money.

ReplyDeleteIt is also not an investment; because it funds nothing that produces value.

What it is, is a collectable, like beanie babies and tulips.

Taxpayers should not fund the effort to regulate crypto, other than to ringwall it, so that it cannot claimed as assets by financially important institutions. The government should make it clear that if you want to gamble on finding a bigger fool, you are on your own.

I agree with most of what you say. It's not an investment and is mainly gambling. I disagree with you that gamblers don't deserve some very basic regulatory protections, especially since crypto gambling mimics so many elements of traditional investing.

Delete