(This isn't a piece of financial advice. It's more of a fun parable about interest rates.)

So here's an interesting financial riddle. Let's say I want to buy a used car for $1000.

First, I need a loan. Say that there are two floating rate loans available to me: one that currently costs 3.2% per year, and another that costs 2.3%. Logic dictates that I should take the cheaper 2.3% option, right? But I don't. Instead I take the more expensive one, figuring to myself that the expensive 3.2% loan is actually the cheaper loan.

Why on earth did I do that?

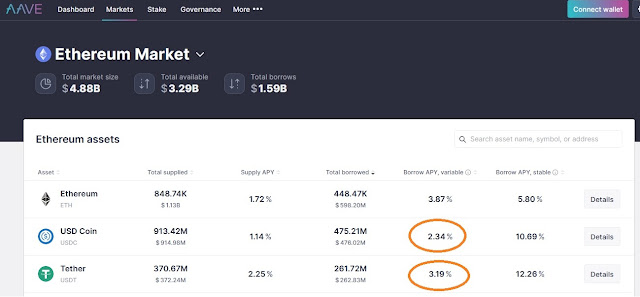

The rates in question are from the website for Aave, a tool for borrowing and lending cryptocurrencies, including stablecoins:

|

| The cost of borrowing two different stablecoins on Aave [source] |

If I borrow 1000 Tether stablecoins from Aave to fund my purchase of the $1000 car, it'll cost me 3.2%. But if I borrow 1000 USD Coins, it'll cost me just 2.3%. Those are floating rates, not fixed. (I could also borrow stablecoins on a fixed basis. A fixed-rate Tether loan would cost me 12.26% on Aave, a USD Coin loan 10.69%. Again, it's more expensive to borrow Tether.)

Why would I pay 3.2% to borrow one type of U.S. dollar, Tether, when I can get another type of U.S. dollar, USD Coin, at a cheaper rate? I mean, they're both dollars, right? They each do same thing; that is, they both provide me with the means to buy a $1000 car.

To see why I might prefer the more expensive Tether loan, we need to understand why the rates on Tether and USD Coin differ:

If I borrow 1000 stablecoins to buy a $1000 car, eventually I'll have to buy those 1000 stablecoins back in order to repay my loan. Wouldn't it be nice if, in the interim, the stablecoin I've borrowed loses its peg and falls in value? Because if it were to do so, I'd be able to buy back the 1000 stablecoins on the cheap (say for $400 or $500), pay back my 1000 stablecoin loan, and keep the $1000 car.

In short, I'd be getting a $1000 automobile for just $400-$500 plus interest.

By contrast, if I were to borrow a more robust stablecoin in order to purchase the car, then that'd reduce the odds of its price being weak when it comes time to repay my loan, thus making the entire transaction more expensive to me.

A $1000 car would cost me... $1000 plus interest.

We can imagine that all potential borrowers are perusing Aave's loan list with that exact same thought in mind. Jack wants to finance a house for $250,000 by getting a stablecoin loan on Aave. Jane wants to borrow $100 in stablecoins on Aave to pay off her credit card debt. All three of us would really, really, really, like to borrow a stablecoin that fails, reducing the net cost of our purchase. So we all do our respective research and select what we believe to be the stablecoin with the worst prospects, the one most likely to be worth just 40 or 50 cents when it comes time for us to repay our debt.

The competition between the three of us to borrow the worst stablecoin will cause borrowing rates for the worst stablecoins to rise. Conversely, borrowing rates on the stablecoins with the best prospects will fall.

And that's what I suspect is happening on Aave. Tether is seen as the riskier stablecoin. And so from the perspective of the borrowing public, a Tether loan is superior to a USD Coin loan. Jack, Jill, and myself are all scrambling for the privilege of borrowing Tether, in the process pushing the cost of borrowing Tether 0.9% above the cost of borrowing USD Coin.

Now we can get back to the original riddle. Even though the rate to borrow Tether is higher than the rate to borrow USD Coin, it may be worthwhile for me to go with the a Tether loan if I think that the odds of Tether failing justify the higher financing cost.

We can even go a bit further and say that the 0.9% premium on a Tether loan is the market's best estimate of the odds of Tether losing its peg relative to USD Coin losing its peg. So for all those would-be stablecoin analysts out there, keep your eye on Aave's USD Coin-Tether spread. It's a good indicator of stablecoin risk.

P.S: The difference between the cost of borrowing Tether and USD Coin could also be due to the liquidity premium on Tether being larger than the liquidity premium on USD Coin. I'm not going to get into that possibility in this post, but if you're curious ask me about it in the comments.

P.P.S: Does this same logic apply to borrowing from banks? Would I rather borrow from a bank that's about to fail rather than a solid respectable bank?

P.P.P.S: Some Dune dashboards tracking he Tether-to-USD rate premium: here and here.

in most cases, usdt can be both collateral assets and borrow assets. So I think the interest rate depends more on the liquidity of the assets on the platform. It will make more sense if aave is a non-collateral loan platform.

ReplyDeleteusdt was delisted in aave v3, its an official 'statement' that usdt is unsafe

ReplyDeleteIf it was delisted, why am I seeing it here?

Deletehttps://app.aave.com/markets/?marketName=proto_polygon_v3

There's $5.98 million USDt on Aave V3 Polygon as of today.

sorry I mean in eth market

Deletehttps://app.aave.com/markets/?marketName=proto_mainnet_v3

Deleteand usdt is an isolated collateral now, while it wasnt before

Delete