Tuesday, May 7, 2013

Long chains of monetary barter

'...the peculiar feature of a money economy is that some commodities are denied a role as potential or actual means of payment. To state the same idea as an aphorism: Money buys goods and goods buy money but in a monetary economy goods do not buy goods. This restriction is - or ought to be - the central theme of the theory of a money economy.' -Robert Clower [A Reconsideration of the Microfoundations of Monetary Theory, 1967]

I started to sell some of my XRP yesterday, and the process of doing so brought to mind Robert Clower's famous quote. Clower's aphorism describes an idealized pure-money economy that exists only in theory. Were we to apply it to the real world, we'd be missing a lot. To begin with, Clower omits "money" for "money" transactions like the XRP trade I'm about to describe.

XRP is the cryptocurrency used to pay transaction fees in the Ripple system. In order to arrive at my end goal of holding Canadian paper, I have to enter into a surprisingly long line of transactions. Which underlines a point I've made before: we don't live in a monetary world characterized by one universal "money". Rather, we target a final state of liquidity appropriate to our goals, and then engage in a series of barter swaps across items with differing liquidity profiles in order to reach our target. Our final resting state may be XRP or bitcoin, it may be a bank deposit, it may be cash, or it might be an item in inventory destined for final sale. To get there requires a long monetary bartering process.

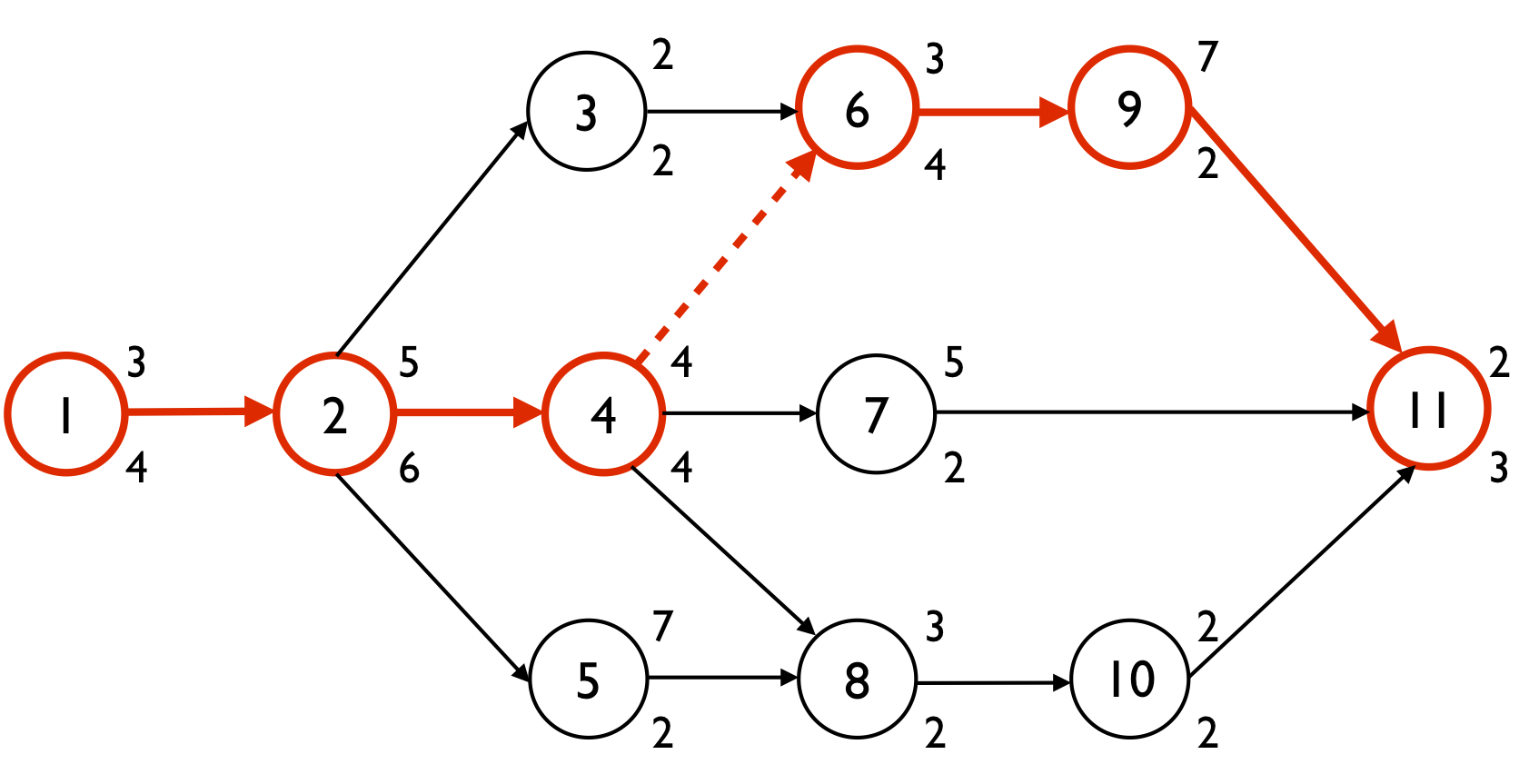

Here is the rather circuitous route I am currently taking in order to convert XRP into Canadian loonies.

Trades:

1. Sell XRP for bitcoin-denominated IOUs issued by Bitstamp. This is a floating exchange rate.

2. Sell bitcoin-denominated Bitstamp IOUs for actual bitcoin. This is at a fixed rate.

3. Sell bitcoin for bitcoin-denominated VirtEx IOUs. Fixed rate. VirtEx is Canada's largest bitcoin exchange.

4. Sell bitcoin-denominated Virtex IOUs for Canadian dollar-denominated Virtex IOUs. Floating rate.

5. Sell Canadian dollar-denominated Virtex IOUs for Canadian dollar-denominated Royal Bank of Canada IOUs. Fixed rate.

6. Sell Royal Bank IOU for loonies & Canadian currency. Fixed rate.

So after six transactions, I'll finally hold Canadian paper money in my wallet. It'll take at least 5 days to execute this chain of transactions, mainly because step 5 takes f.o.r.e.v.e.r. This is the fault of our legacy banking system. The cryptocurrency world, steps 1-4, is blazingfast.

Alternatively I could cut a few steps out:

1. Sell XRP for bitcoin-denominated IOU issued by Bitstamp.com. This is a floating rate.

2. Sell bitcoin-denominated Bitstamp IOU for bitcoin. This is a fixed rate.

3. Go to a local cafe where someone makes a market in bitcoin. Sell my bitcoins directly for cash at a floating rate.

We experience these long barter chains in the non-crypto world as well. When I am paid with a US dollar check (say for $50), I go to my bank and sell the check at par for $50 worth of USD deposits. Then I sell the bank my new USD deposits in return for $55 or so worth of Canadian deposits, depending on what the exchange rate at that moment.

My next monetary barter transaction depends on what I want to do after. If I want to get a haircut, I'll sell the $55 worth of deposits back to the bank for $55 worth of Canadian paper money. After all, my barber only takes cash. If I want to buy stock, say Blackberry, I'll sell my bank deposits for an equivalent amount of deposits at my broker, and then I'll be able to purchase Blackberry.

Behind the scenes, the bank's transaction chain continues. After buying the check from me, it sells it back to the issuing US bank in return for a deposit at the issuer. It then sells the issuer's deposit for central bank reserves/clearing balances. Long chains of monetary barter.

The other problem with Clower's simplification is that goods often do buy goods.

The word for this in a retail setting is barter. In a corporate setting it is countertrade. One example of countertrade are "soft dollar" practices in the financial industry. Fund managers or investment advisers promise to provide brokers with order flow. In return, managers and advisors enjoy various services such as the broker's internal research, third-party research, data, or exclusive access to new deals. Brokers will sometimes pay for the fund manager's rent, computers, electricity bills, or even vacation in return for trade flow. If the brokerage industry had to rely purely on hard dollar rather than soft dollar transactions, the whole industry would collapse (or so some people say).*

In sum, there is no rule that money must buy goods only, or goods money. The world is far more complex than this. Goods are more moneylike than we suppose, and so-called money is isn't a monolithic entity but a heterogeneous set of goods that get bartered for each other along long monetary chains.

*Just as barter is often used to avoid leaving a paper trail, so are soft dollar trades used in the financial industry. Soft dollar expenses are not included in your mutual fund's management expense ratio (MER). You may think that the fund you own has low expenses, but until you back out soft dollar barter its engaged in you can't be sure. The more a fund manager can stuff into soft dollar, the cheaper his/her MER appears. Read the fine print.

Labels:

barter,

bitcoin,

Ripple,

Robert Clower

Subscribe to:

Post Comments (Atom)

Money indeed is not a monolithic entity and thank you very much for reminding us this, including clear examples, because apparently most economists from all schools appear to be entirely oblivious to this and it tends to drive me nuts.

ReplyDeleteThe distinction (or lack thereof) though goes beyond economists and is a part of our appraisal of social interactions. Whereas exchanging sex for cash is often frowned upon, exchanging it for movie tickets and a restaurant bill is nowhere that controversial. An Austrian might object that it is not really the same good that is being exchanged, which is fine, but my point is that this alone is not a sufficient reason to reject the catallactic foundation of an exchange. I recall that in one lecture, Philipp Bagus used the example of finding a girlfriend as an extreme case of double coincidence of wants, so clearly I'm not the only one entertaining such thoughts.

Hmm, now that I think about it, with a bit of exaggeration, an Austrian might say that exchanging sex for movie tickets and a restaurant bill is a more roundabout method of production and signifies a lower time preference :-).

DeleteDefinitely agree with you that people act differently when an exchange is conducted using goods versus an exchange conducted with paper. If friends help you out when you're moving from one place to the next, they'll be insulted if you offer to pay them in dollars, but if you offer to take them out for pizza they'll happily accept.

DeleteWouldn't it be easiest though if you could just buy coffee with Bitstamp CAD-denominated ripple IOUs? There's inefficiency with pricing goods in bitcoin due to it being volatile in Canadian CPI terms.

ReplyDeleteBTW I'm in contact with some people talking about building a ripple startup and was wondering what you thought might be useful applications of ripple.

"...was wondering what you thought might be useful applications of ripple."

DeleteI think you already answered your own question. Figure out a way for people and businesses to exchange coffee for CAD-denominated ripple IOUs.

This is great, really addresses my issue, that any financial asset/unit of exchange's liquidity is *relative to* other particular units of exchange/real goods. So:

ReplyDeleteo Any UOE has multiple liquidities

o The liquidity of UOE A relative to UOE B may be dependent on its liquidity relative to UOE X, Y, and/or Z, because a chain of transactions may be required to get from A to B.

Also points out that "liquidity" may need to be decomposed. May include the ease, the speed, and the predicted certainty of exchangeability, including the certainty of 1:1 exchange as measured in the dominant unit of account. (We could call that "nominal stability"?)

All further pointing out that we simply shouldn't use the word "money" in technical discussions because nobody agrees what it means.

And: "moneyness" is used here I think as a synonym for "liquidity" (?) which I suggest needs a more careful definition itself.

On definitions...

DeleteImagine that you can buy some good x of which there are versions x.1 and x.2. The only difference between these two versions is that if you buy x.1, you can only resell it after one year has passed. If you buy x.2, you can re-market it whenever you want.

Buyers will pay more for x.2 because it provides more potential liquidity services... it has more moneyness. The price premium of x.2 over x.1 is the extra bit of value people will pay to enjoy the x.2's superior liquidity/moneyness.

Put differently, moneyness/liquidity are the set of services provided by a good or asset that you forgo when you irrevocably freeze that good/asset in inventory for a period of time. We can back out a market price for those services, let's call it a liquidity premium or a moneyness premium.

Which gets me thinking about the definition of my UOE term (which I use synonymously with "financial asset.")

ReplyDeleteDoes it refer to:

Apple stock

or

A share of Apple stock.

??

A government bond has X liquidity relative to bank deposits. Y liquidity relative to rolls of quarters. Z liquidity relative to Fed reserves. Every financial asset (or real good, actually) has different liquidities relative to every other asset/good. (Though Asset A's liquidity relative to B and relative to C could be identical or very close, and they could have been that close forever. i.e. one dollar bills relative to five dollar bills.

ReplyDelete