The SEC has been hinting for several years that stablecoins may be securities. I've always found the idea of regulating stablecoins as securities to be a bit odd. No one who buys a stablecoin expects to make a profit. That's because none of the big stablecoins (Tether, BUSD, or USD Coin) have ever paid interest. With no expectation of profit, stablecoins aren't like bonds or stocks or other investment contracts, and thus they shouldn't fall under SEC purview.

Never mind that PayPal, Wise, Payoneer and Cash App all create dollars in the same way as a stablecoin issuers do, and like stablecoins only pay 0% interest. Yet the SEC has never deemed a PayPal balance to be a security.

Anyways, over time we've been getting more clarity on the regulatory status of stablecoins. In February, the SEC issued a warning notice to stablecoin issuer Paxos that, in its view, one of Paxos's stablecoins, Binance USD, was an unregistered security. Notably, Paxos's other stablecoin, USDP, was not mentioned in the notice. Some types of stablecoins seem to be securities, others not.

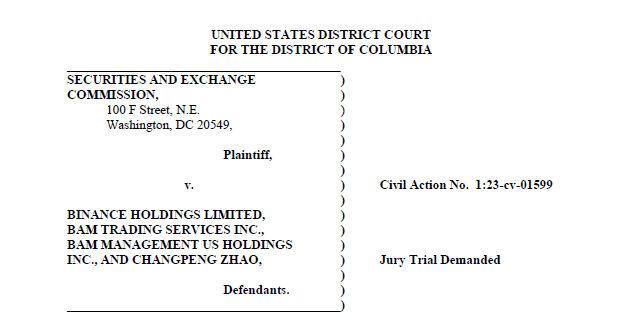

A new lawsuit against Binance provides even more insight into what sorts of stablecoin activity the SEC deems to fall under securities law. Earlier this week, the SEC accused Binance of (among many other things) offering and selling Binance USD, or BUSD, as a security without bothering to register the offering. Paxos's USDP was not mentioned in the suit, nor was any other stablecoin.

To clear up any confusion, BUSD is issued by Paxos but Binance puts its name on the label and markets the coin. It's a partnership.

One reading of the SEC's suit against Binance is that a stablecoin itself isn't a security. Rather, it is the particular way that BUSD's income is shared between Paxos and Binance, combined with the way that Binance offers BUSD to retail customers, that transforms this particular instance of a stablecoin into a security offering.

Here's a short explanation of how the whole BUSD sausage works. The main entry-way for the public into BUSD is via Binance's website. When retail customers buy BUSD on Binance, they submit fiat dollars. Next, the customers' funds are wired to Paxos, a New York-chartered limited trust, where they are pooled and invested in assets that yield interest. Paxos in turn sends BUSD back to Binance to be deposited into Binance-controlled addresses. These underlying BUSD tokens serve as stand-ins for customer U.S. dollar balances on Binance.

According to the SEC, some 90% of all BUSD was controlled by Binance. In a key bit of data, we also learnt that Paxos and Binance split the interest income 50/50.

Any investment of money in a common enterprise constitutes the first key steps towards an investment contract, and an investment contract falls under SEC jurisdiction. In its suit, the SEC is suggesting that when Binance customers bought BUSD, and their funds were pooled and invested by Paxos, the initial triggers for investment contract-status had been met.

However, for an asset to be an investment contract there also needs to be an expectation of profit. Recall that BUSD doesn't pay any interest to customers. A BUSD token is about as unfruitful as a U.S. dollar balance at PayPal or Wise, neither of which are securities.

Here's where the hook appears to have caught flesh. While BUSD tokens are themselves barren, BUSD tokens held on Binance do yield a profit. According to the SEC, Binance offered something called a BUSD Reward Program that "promised interest payments to BUSD investors merely for holding BUSD on the Ethereum blockchain."

The SEC then proceeds to connect Binance's ability to imbue BUSD with "profit potential" to the interest earned on the underlying pooled assets that it splits with Paxos.

And that's why this particular instance of a stablecoin may be a security. If Paxos were to directly pay interest to the public, then BUSD

would obviously be a security, since that establishes an expectation of profit. What has happened instead is that streams of interest income are channeled through to the public by Paxos

paying Binance and Binance rewarding end users. The SEC seems to be saying that this isn't an accepted workaround: two separate entities cannot cooperate and fabricate an interest

return on stablecoins, and avoid having this entire contraption be deemed a security.

Now, that's just my interpretation. I could be wrong. But assuming that I'm right, what does that mean if you are a stablecoin issuer and don't want to run afoul of securities law?

First, never pay direct interest to retail customers. That's why old-school money transmitters like PayPal, Wise, and Cash App don't directly offer interest on balances; and when their customers do get interest, it's either a bank or a money market fund that carries this business out on behalf of the money transmitter.

The particular lesson to be gleaned from the SEC's case against Binance seems to be that in addition to not paying interest to customers, stablecoin issuers should probably be wary of sharing interest income with partners. These partners may sluice the interest back to their own retail customer base, the whole amalgam thus synthesizing into an SEC-regulated security. That may explain why Paxos's BUSD is being targeted by the SEC as a security, whereas Paxos's USDP – which never had a Binance yield-generating nexus – isn't being targeted as a security... at least for now.

How does Coinbase get around this?

ReplyDeleteThey offer customers rewards for holding USDC on Coinbase. And I believe they also get revenue from the assets backing USDC

https://help.coinbase.com/en-au/coinbase/coinbase-staking/rewards/usd-coin-rewards-faq

https://blockworks.co/news/coinbases-circle-investment-reflects-the-shoring-up-of-major-revenue-stream

Or is there any update on whether or not the reason behind the SEC lawsuit was due to "sharing interest income" or something else?

DeleteI wrote about Coinbase's reward program here, which will probably interest you. It revisits some of the same themes as the SEC v Binance lawsuit.

Deletehttps://jpkoning.blogspot.com/2023/09/coinbase-what-if-we-called-them-rewards.html

My guess is that Coinbase will have to withdraw this program or face punishment.