Issued a little less than a year ago, Zimbabwe's bond coin is one of the world's newest monetary units. The bond coin is designed to solve one of the most venerable problems in the pantheon of monetary conundrums; the big problem of small change—a nice turn of phrase coined by economists Tom Sargent and François Velde (excuse the pun).

Some background first. When Zimbabweans spontaneously ceased to use worthless Zimbabwe dollars in 2009 they simultaneously adopted a ragtag collection of currencies including the South African rand and U.S. dollar. Unlike cash, coins are heavy—shipping them over to Zimbabwe from the U.S. is prohibitively expensive. So while Federal Reserve banknotes have tended to be used in large value transactions, rand coinage from neighbouring South Africa has been recruited for use in smaller transactions. Unfortunately, there has never been enough coins to conduct trade. The demand for small change is so large that items like gum or candies or IOUs have often been used as coin-substitutes.

The bond coin is a brave attempt by the Reserve Bank of Zimbabwe's (RBZ) incoming Governor John Mangudya to fix the small change problem. Issued in denominations of 1, 50, 10, 25, and 50 cents, each bond coin is worth an equivalent amount of U.S. cents. Issuing small change is an entirely sensible goal for a central banker to pursue. It's low hanging fruit—a cheap solution to a significant problem that disproportionately hurts those who rely on coins the most, the poor.

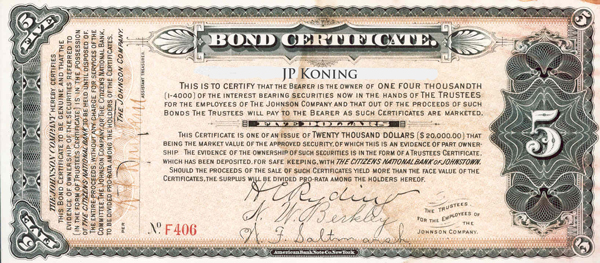

But how can an institution that has lost all credibility—and deservedly so—successfully float a new monetary unit? Only with a little bit of help, it seems. The RBZ's FAQ on bond coins says that the new issue is backed by a "bond facility." What does this mean? Unfortunately the RBZ forgot to answer that question in its FAQ, as the screenshot below indicates (ht Twitter finance's @guan).

Oh dear.

Reading through some earlier news reports, let me try and answer on their behalf. We know that the African Export-Import Bank (Afreximbank), based in Cairo, opened up a US$200 million line of credit with the RBZ last year. Presumably some portion of this line of credit will be used to ensure that bond coins stay pegged to the U.S. dollar. Should the bond coin fall below the dollar, for instance, the RBZ will have to draw down on its bond facility with Afreximbank to repurchase the coins. Thus the moniker "bond coin." At least, that's the story that the RBZ Governor John Mangudya has been providing. So far the value of bond coins has held, so Zimbabweans see Afreximbank backing as credible.

The minting of U.S. dollar tokens isn't a novel idea. Other dollarized nations have introduced coins to make up for the lack of U.S. change. Panama, for instance, has the balboa while Ecuador and East Timor have the centavo. Zimbabwe's is a well-trodden path.

The RBZ's new coins were initially greeted with a large amount of skepticism. No wonder. This is an institution that generated an inflation rate of 79.6 billion percent (with the help of Robert Mugabe's insane fiscal policy). However, a sudden glut of news articles say that Zimbabweans have begun to embrace bond coins in earnest. At the same time, no one wants South African currency anymore, with retailers and banks increasingly refusing rand coins.

Why is that? Zimbabweans have been transacting with both rand and dollars since 2009 but they have been setting prices in the latter. The dollar, not the rand, is the unit of account. This means that any transaction involving rand is inconvenient as it requires a foreign exchange conversion back into dollars prior to consummation. Over the last few years, Zimbabweans have solved this problem by the informal adoption of a "street" rate of ten rand-to-the dollar. They use this rate as a rule of thumb even though the market exchange rate has deviated quite far from it. The advantage of a nice round number is that it reduces the calculational burden of a two currency system.

For instance, one of the more ubiquitous commercial experiences in Zimbabwe, a ride on a privately operated bus, or kombi, has been priced at $0.50, or five rand, for many years now. It's interesting that this price has undervalued the rand relative to its actual market rate. In 2012-2013 the U.S. dollar was worth around eight rand, so a kombi ride should have only cost commuters four rand, not five. But convenience seems to have trumped exactitude, especially with small change being so hard to come by.

With the greenback having spiked in late 2014 and 2015, the U.S. dollar is now worth around fourteen rand. In this context, the old informal ten-to-one exchange rate no longer makes much sense. A massive coordination problem seems to have developed. While kombi drivers still charge fifty U.S. cents per ride, they have reportedly begun to charge as much as seven rand for a trip, or a 14-to-one exchange rate, thus breaking with the traditional ten-to-one street rate. Customers are not happy. When they pay with US$1, they are now asking for a 50 cent bond coin as change. After all, if they get five rand in change, that won't be enough to afford the new seven rand price on their next ride.

The period of economy-wide haggling necessary to settle on a new generally accepted "street price" for the rand no doubt imposes significant costs on Zimbabwean society. Thorny issues of fairness come to the forefront. And if the new rate isn't a nice round number, payment calculations becomes a burden. Before the bond coin's appearance on the scene, Zimbabwe would simply have endured this period of rand-induced calculational turmoil as it slowly groped to a new equilibrium. But this time there's a small change alternative to the rand. The sudden adoption of the once unpopular bond coin by Zimbabwean society may be a convenient hack for getting around the complexity of adjusting to rand volatility. If so, all that the bond coin needed for mass adoption was either a sharp rise or fall in the rand. Without that volatility—i.e. if the rand exchange rate had stayed near ten-to-one forever—then the requisite chaos for bond coin acceptance would never have appeared.

Monetary economists have long debated the idea of a divorce between a nation's unit-of-account and its medium-of-exchange. (See Tyler Cowen, for instance, on New Monetary Economics). This is the notion that a nation's prices can be set in terms of one unit and its transactions carried out in another; a notion exemplified in Zimbabwe where prices are set in dollars but rand trades hands. I think Zimbabwe's recent adoption of the bond coin bears out economist and blogger Larry White's stance on the subject. White, who wrote a skeptical paper on the prospects for medium-unit divergence, maintains that the practice of harmonizing the unit in which we transact with the unit for posting prices is an evolutionary inevitability. A divorce is simply not in the self interest of economic actors. Harmonization-

...economizes on time spent in negotiation over what commodities are acceptable in payment and at what rate of exchange. More importantly, it economizes on the information necessary for the buyer's and the seller's economic calculation.For these reasons, a unit of account is typically "wedded" to a general medium of exchange, says White. In Zimbabwe, the convenience of wedding the medium-of-exchange with the unit-of-account is playing out in the mass disgorgement of rand and adoption of US$-denominated bond coins. This is just another chapter in Zimbabwe's ongoing game of monetary musical chairs. Having spontaneously demonetized the Zimbabwe dollar in 2009 for the rand, they are now demonetizing the rand in favour of Zimbabwean U.S. dollars. If White is correct, expect this new evolution to be a permanent one.