Now that the U.S. debt ceiling season is upon us again, I've been wondering if the U.S.'s official gold price is going to finally be revalued from $42.22. Why so?

Since March the U.S. Treasury has been legally prohibited from issuing new debt. Because the government needs to continue spending in order to keep the country running, and with debt financing no longer an option (at least until the ceiling is raised), Treasury Secretary Mnuchin has had no choice but to resort to a number of creative "extraordinary measures," or accounting tricks, to keep the doors open. Here is a list. They are the same tricks that Obama used in his brushes with the debt ceiling in 2011 and 2013.

The general gist of these measures goes something like this: a number of government trusts and savings plans invest in short term government securities, and these count against the debt limit. As these securities mature they are typically reinvested (i.e rolled over). The trick is to neither roll these securities over nor redeem them with cash. Instead, the assets are held in a limbo of sorts in which they don't collect interest—and no longer count against the debt limit. This frees up a limited amount of headroom under the ceiling that the Treasury can fill with fresh debt in order to keep the government functioning.

These tricks provide around $250-300 billion of ammunition. Which sounds like a lot, but in the context of overall government spending of $3.7 trillion or so per year, it isn't. Most estimates have the extraordinary measures only lasting till September or October at which point a default event may occur, unless Congress raises the ceiling.

Not on the official list of measures for finessing the debt ceiling is a rarely-mentioned option that I like to call the gold trick. The U.S. government owns a lot of gold. Beware here, because a few commentators think that the idea behind the gold trick is to sell off some of this gold in order to fund the government. Nope—not an ounce of gold needs to be sold. The only thing that the Treasury need do is raise the U.S.'s official price for gold. By doing so, it automatically gets "free" funding from the Federal Reserve, funding which doesn't count against the debt ceiling.

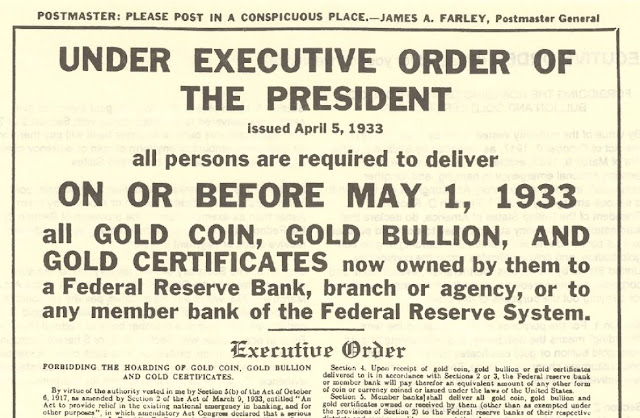

We need a bit of history to understand the gold trick. Back in 1933 all U.S. citizens were required to sell their gold, gold certificates, and gold coins to the Fed at a rate of $20.67 per ounce. This is the famous gold confiscation that gold bugs like to talk about (see picture at top). The 195 million ounces that the Fed accumulated was subsequently sold to the Treasury. In return, the Treasury provided the Fed with gold certificates obliging the Treasury to pay them back. At the official price of $20.67, these certificates were held on the Fed's books at $4 billion.

The certificates the Fed received were a bit strange. A gold certificate usually provides its owner with a claim on a fixed quantity of gold, say one ounce, or 1/2 an ounce. In this case, the certificates provided a claim on a nominal, not fixed, amount of gold. If the Fed wanted to redeem all its certificates, it couldn't ask the Treasury for the 195 million ounces back. Rather, the certificates only entitled the Fed to redeem $4 billion worth of gold at the official price.

As long as the yellow metal's price stayed at $20.67, this wasn't a big deal. But it had important consequences when the official gold price was changed, which was exactly what happened in January 1934 when President Roosevelt increased the metal's price from $20.67 to $35. At this new price, the stash of gold held at the Treasury was now worth $6.8 billion, up from $4 billion. But thanks to their odd structure, the value of the Fed's gold certificates did not adjust in line with the revaluation—after all, they offered little more than a constant claim on $4 billion worth of gold. The remaining $2.8 billion worth of gold, which had been the Fed's just a month before, was now property of the Treasury.

Almost immediately the Treasury printed $2.8 billion worth of fresh gold certificates, shipped these certificates to the Fed, and had the Fed issue it $2.8 billion in new money. Voila, the Treasury had suddenly increased its bank account, and it didn't even have to issue new bonds, raise taxes, or reduce program spending. All it did was change the official gold price.

(If you want find this description confusing, I explained the gold trick slightly differently in 2012.)

---

Even when the U.S. eventually went off the gold standard—unofficially in 1968 and officially in 1971—it still maintained the practice of setting an official gold price. But by then the official price was no longer the axis around which the entire monetary system turned; it was little more than an accounting unit.

As gold's famous 1970s bull market started to ramp up, the authorities tried to keep pace by enacting changes to the official price. When gold hit $55 in May 1972, the official price was bumped up from $35 to $38. They ratcheted it up again in February 1973 to $42.22, although by then gold's market price had advanced to $75. Both of these revaluations resulted in the Fed providing new money to the Treasury, just like in 1934. Albert Berger, a Fed economist, has a good description of these two events:

A 1974 Fed analysis of the effects of raising the official gold price: https://t.co/XP2pka1YoR & my old blog post: https://t.co/G1SLGD6QTH pic.twitter.com/QDdMIsxVLK— JP Koning (@jp_koning) January 9, 2017

After the 1973 revaluation the government stopped trying to keep up to gold's parabolic rise, and to this day the U.S. maintains an archaic price of $42.22, far below the actual price of $1250 or so.

---

Let's bring this back to the present. Come October, imagine that the U.S. Treasury has expended all of its conventional extraordinary measures and Congress—despite having a Republican majority—can't decide on increasing the debt ceiling. Desperate for the cash required to keep basic service open, Treasury Secretary Mnuchin turns to an archaic, long forgotten lever, the official gold price. Maybe he decides to change it from $42.22 to, say, $50, or $100, or $1000—whatever amount he needs in order to fund the government. The mechanics would work exactly like they did in 1934, 1972, and 1973. The capital gain arising from a rise in the accounting price would be credited to the Treasury in the form of new central bank deposits, and these could be immediately deployed to keep the government running.

Any change in the official price of gold needs to be authorized by Congress. Why would the same Congress that can't agree on adjusting the debt ceiling or repealing Obamacare agree to Mnuchin's request to change the price of gold? The Republican party has a long history of advocating for the gold standard; Ronald Reagan, for instance, was a supporter. President Trump himself likes the yellow metal. If you believe him, he once made a lot of money off of it:

Donald Trump, gold speculator. "It's easier than the construction business." https://t.co/3bgcGgo4Yn pic.twitter.com/khBOELaiEH— JP Koning (@jp_koning) November 29, 2016

As for the Republican's base, many of them are keen on ending the Fed—anything that smells of a return to gold will make them happy. This seems to be a piece of legislation that pleases all factions.

The gold trick only works because the debt issued by the Fed—reserves, or deposits—is not included in the category of debts used to define the debt ceiling. By outsourcing the task of financing government services to the Fed via gold price increases, the Treasury can sneak around the ceiling. This is only cosmetic, of course, because a debt incurred by the Fed is just as real as a debt incurred by the Treasury, and so it should probably be included in the debt ceiling. After all, the taxpayer is ultimately on the hook for debt issued by both bodies.

An increase in the price of gold to its current market price of $1250 would only be a band-aid. While it would provide the Treasury with around $315 billion in new funds from the Fed, this would be enough to evade the debt ceiling for just a few months, maybe half a year. Sure, a few well-time Donald Trump tweets about the greatness of gold might push the price up by $50 to $1300, but even that would only buy the Treasury an extra $13 billion or so in central bank funds.

---

The Fed would hate the gold trick.

Much of Fed policy over the last few years has involved communicating with the public about the future size of the Fed balance sheet, which shot up over three rounds of quantitative easing. A sudden $315 billion increase in liabilities outstanding due to a revaluation of the official gold price to $1250 would throw a wrench in this strategy. To the public, it would look QE4-ish.

QE is reversible. Unlike QE, the Fed would not be capable of reversing a balance sheet expansion caused by a gold revaluation, at least not without the Treasury's help. This would severely damage the Fed's independence. To see why, keep in mind that the Fed can only ever increase the money supply if it gets an asset—a bond, mortgage backed securities, gold, etc—in return. The advantage of having an actual asset in the vault is that it can be sold off in the future should a constriction in the money supply be necessary. Assets also generate income which can be used to pay the Fed's expenses like salaries or interest on reserves. With the gold trick, however, the Fed is being asked to increase the money supply without receiving a compensating asset. This means that, should it be necessary to drastically shrink the money supply in the future, it will only be able to do so by relying on goodwill of the Treasury. So much for being able to act independently of the President.

That the Fed probably prefers that the Treasury avoid a gold revaluation is one reason that it has never become one of the go-to extraordinary measures for finessing the debt ceiling. But I'm not sure that the current administration is one that cares very deeply about what the Fed thinks. If Congress greenlights the revaluation, there's really nothing that Fed Chair Yellen can do except enter-key new money for Mnuchin.

---

Earlier I mentioned that adjusting the official price to $1250 would only be a band-aid solution. Here's a bit of speculative fiction: imagine that come October the official price is adjusted up to something like $2000, or $5000, or $10,000. Granted, this would put it far above the market price of $1250--but the official price has been wrong for something like fifty years now; does anyone really care if the error is now to the upside rather than the downside?

At an official price of $10,000, for instance, the Treasury would get some $2.6 trillion in spending power from the Fed, enough for it to avoid issuing new t-bills and bond in excess of the debt ceiling for several years. The Republicans would save face; they could tell their constituents that they held firm against an increase in the ceiling. When the Democrats--who are no friends of gold--inevitably come back to power, they could simply go back to the tradition of jacking up the debt ceiling.

This would certainly be a strange world. During Republican administrations, bond and bill issuance would slow dramatically, reserves at the Fed expanding in their place. Like the various QEs, there is no reason that these reserve expansion would cause inflation. The Fed would have to be careful that it pays enough interest on reserves that banks prefer to hoard their reserves rather than sell them. This increase in the Fed's interest burden would dramatically crimp its profits, which are paid out as a dividend to the Treasury each year. In fact, all the money the Treasury saved on not paying t-bill and bond interest would be almost precisely cancelled out by a shrinking Fed dividend. There is not much of a free lunch to be had.

Investor who like to hold government debt in their portfolios would be in a bit of a jam. Everyone can buy a t-bill, but the ability to hold reserves is limited to banks. Unless the Fed were to allow wider access to their balance sheet, Republican administrations resorting to the gold trick would create broad safe asset shortages.

While a small increase in the official gold price may be part of Mnuchin's backup plan, a large increase to the official gold price is just speculative fiction. After all, a boost in the official price of gold to $10,000 would create an entirely different monetary system. Alternative systems are certainly worth exploring for what they teach us about are own system, but one would hope that the actual adoption of one would come after long debate and not as a result of opportunistic politics.

P.S. After writing this post, I stumbled on a paper by Fed economist Kenneth Garbade which describes how Eisenhower finessed the debt ceiling by using a version of the gold trick. Unlike 1972 and '73 the gold price was not increased. Instead, the Treasury was able to make use of unused space from the 1934 revaluation. A large portion of the gold the Treasury owned had not yet been monetized by writing up gold certificates and depositing them at the Fed. In late 1953, with the debt ceiling biting, around $500 million in gold certificates were exchanged with the Fed for deposits.