Over the years I've had a lot of connections to the Bank of Montreal. I'm a disgruntled ex-customer, a fairly happy shareholder, and a former employee. I stopped being a customer after the Bank of Montreal began charging me monthly fees in the middle of the pandemic without telling me, and I didn't notice for over a year. They refused to refund the fees, so I walked.

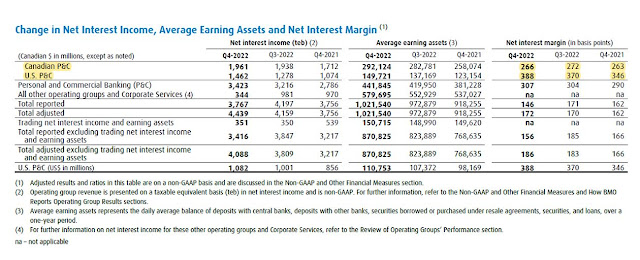

In any case, given my multiple interactions with the Bank of Montreal, I try to keep tabs on what it is doing. I was glancing through the bank's 2022 annual financial statement and stumbled on the following notable table:

|

| Source: BMO. P&C refers to personal & commercial banking |

The bits that struck me are in yellow. Bank of Montreal's net interest margin is much higher in the U.S. than Canada. By way of background, Bank of Montreal is fairly unique in that it operates as a sizable commercial bank on both sides of the U.S.-Canada border. So its data, including its margins, provides some interesting insights into the fundamental differences between U.S. and Canadian banking.

Net interest margin is a measure of how much a bank is squeezing out of its customers. To calculate it, start by counting up how much money a bank makes in interest on its loans. Then subtract from that its interest costs: all the money it pays out to depositors in the form of interest. That difference is the bank's net interest. Divide net interest by all of the money it makes on its loans to get net interest margin.

Banks want higher margins. Their customers don't. The higher the net interest margin, after all, the more interest the bank is extracting from its customers.

In Bank of Montreal's case, its margin in the fourth quarter is 3.88% in the U.S. and 2.66% in Canada. So for every $100 it lent, the bank collected net interest of $3.88 in the U.S. but just $2.66 north of the border. In short, Bank of Montreal was much better at squeezing Americans than Canadians in 2022. That difference in margins doesn't sound like much, but repeated over billions of dollars it comes to quite a gap.

This isn't a fleeting phenomenon. I glanced over the last 10-years of Bank of Montreal financial data, and its U.S. net interest margin has been consistently superior to its Canadian margin over that entire period.

This goes against my long-standing stereotype of Canadian vs U.S. banking, which goes a bit like this:

I've always thought that it was better to be a U.S. banking customer than a Canadian one. Canada once had a fairly vibrant banking sector, but after many waves of mergers and acquisitions it has consolidated to the point that we've really only got five big bank. Everyone refers to them as an oligopoly. Everyone. I recall that even the Bank of Montreal's in-house bank equity analyst routinely referred to Canada's big 5 as an oligopoly in his research reports.

To make matters worse, Canada prevents foreign competitors from entering and stirring up the pot.

But America is huge and thus capable of supporting a much richer range of banks. For instance, the big 5 Canadian banks hold assets equal to 2.5 times Canada’s gross domestic product, but the assets of the five largest U.S. banks amount to just 0.4 times of that country’s GDP. See the chart below:

This chart from @jason_kirby really gives a feel for how much more concentrated Canadian banking is relative to the U.S.

— John Paul Koning (@jp_koning) April 28, 2022

via https://t.co/L4cosgydaN pic.twitter.com/A872GimuI3

This lack of concentration means that U.S. banks don't have the same oligopolistic stranglehold over Americans that Canadian banks do.

On top of that, U.S. commercial culture is more cutthroat than Canada. Whereas foreign banks are locked out of Canada, they can freely enter the U.S. market. And so I saw the U.S. as an arena for ferocious bank competition, with customers benefiting in the form of better services and higher interest rates. Meanwhile, we Canadians are getting stiffed by our banks.

But after looking Bank of Montreal's net interest margins, I'm not so sure about my stereotype. A lower net interest margin in Canada means that the bank is extracting a smaller pound of flesh from its Canadian customers, which suggests more banking competition up here, not less.

Incidentally, net interest margin doesn't include those pesky user fees we all hate, or what Bank of Montreal calls non-interest revenue. And we know that the Bank of Montreal ruthlessly skins its customers for fees; after all, that's why I closed my account. However, even after adding Bank of Montreal's non-interest revenues to its net interest income on both sides of the border, its Canadian banking business still only sports a margin of 3.5% in fiscal year 2022 compared to 4.5% for its American business.

That is, even after accounting for pesky user fees, Bank of Montreal is still gouging its American customers more than it gouges its Canadian ones.

Admittedly, Bank of Montreal provides just a single data point. So I cast around for more data, and stumbled upon a database called Bankscope, hosted on the Federal Reserve's FRED. Bankscope is a popular source of bank balance sheet information among banking economists.

Here is what U.S. and Canadian net interest margins from Bankscope look like:

|

| Chart source: FRED |

It confirms my Bank of Montreal anecdote. Going back to 2000, banking net interest margins in the U.S. have been consistently higher than in Canada, and by quite a large amount.

To sum up, given the preceding data I may have to revamp my conceptions of Canadian and U.S. banking. It's true that we have an incredibly concentrated banking sector up here in Canada, with the big 5 controlling an outsized chunk of the market. Paradoxically, this "oligopoly" doesn't translate into higher net interest margins for Canadian banks. Margins are actually more elevated in the the hotbed of capitalism, the U.S., even though its banks are far more diffused. This margin difference suggests that competition among banks is more strident north of the border than south of it.

In short, although the bastards at the Bank of Montreal skinned me for a bunch of fees during the pandemic, the bigger picture is that it's better to be a customer of a Canadian bank than a U.S. one.

Is it possible that they are assigning more of the back-end operational and corporate costs to the Canadian side than the US side? Is it possible that the average deposits per branch is higher in the US than Canada? Is average productivity (perhaps due to regulations) higher in the US?

ReplyDeleteThis would change the picture. It might even be that even though the bank does does better in the US, the customer might still come out ahead, confirming your priors.

"Is it possible that they are assigning more of the back-end operational and corporate costs to the Canadian side than the US side?"

DeleteIt's possible. But the net interest margin is comprised of revenues before those sorts of non-interest costs are deducted, so it illustrates the pure amount of net interest that banks can extract from customers. And banks are getting a bunch more out of Americans than Canadians, it would appear.

Is it possible you are observing differences in business mix? I am not an expert on these banks but had a sense that Canadian banks had more housing loans on balance sheet while the US less so due to securitisation. Also wonder if variance in interest rate (variable versus fixed with free prepayment option?). Would also be interesting to see if differences in NIM are reflected in differences in return on equity?

ReplyDeleteFair points. I am not properly accounting for the different sorts of lending these banks do. I'd need to come up with some sort of risk-adjusted margin.

DeleteInterestingly, on the deposit side, BMO consistently pays more interest to Canadian than Americans, even when t-bills rates in the two countries were mostly similar over the period from 2017-now. See: https://twitter.com/jp_koning/status/1602371110250725397

While differences in lending risk could definitely drive US net interest margins higher, presumably interest rates on deposits should be more uniform across countries. For some reason it appears better to be a Canadian depositor than a US one (although once again, BMO is just one data source.)

May have something to do with the fact that a Canadian bank’s equity capital position – which is a very significant original source of Canadian dollar funding - is denominated in Canadian dollars

ReplyDeleteSo the aggregate Canadian book includes a net equity position whose nominal interest cost is zero

No such common equity mismatch benefit exists in the US book – it’s all interest paying liabilities – so gross interest margins need to be higher.

And the overall US dollar asset-liability position needs to be more or less matched in order to control overall FX risk

Hi JKH, long time no hear.

DeleteThat's a bit over my head. You say the US book is all interest paying liabilities. Potentially dumb question: wouldn't they allocate some of the equity capital to the US side? And so wouldn't the US book also be partly funded at a cost of zero interest?

Again I speak with no authority on this particular bank but, for what it is worth, a banking group might try to maximise the debt funding of one part of the group in order to shift profits to areas with lower tax rates. Tax authorities naturally don’t like that and so use thin capitalisation rules to limit this happening.

DeleteGood point JP.

DeleteAnd a good example of why I sometimes hedge my comments – as in “may have something …”

It also hurts my head to think about this stuff after being out of the game for so long.

: )

The devil here may be in the details here about how the bank actually identifies a net interest margin for each business/currency case, and whether it employs some sort of transfer pricing of “attributed” funds in order to define an interest margin by currency and by business.

The fact remains that the US dollar asset portfolio in aggregate does not benefit from the existence of a US dollar equity capital position that provides actual funding position at a 0 interest cost. And the actual Canadian dollar equity capital position is not swapped via the foreign exchange markets into US dollar funding to create a comparable US dollar denominated zero cost equity capital position. The banks equity capital position is still in Canadian dollars, and this has a direct effect as zero interest cost funding for the Canadian dollar denominated balance sheet – viewed in aggregate. Somehow, this structural difference has to be reconciled in how the bank approaches the decision to invest in US dollar businesses rather than Canadian dollar businesses. That may also put upward pressure on target interest margins in US dollars - since US dollar asset investment does not enjoy an actual US dollar funding benefit (at least in terms of related actual interest expense) in the form of actual US dollar denominated equity capital.

It also may be the case that there’s some “attributed” transfer pricing stuff going on in those published interest margin numbers – in order to reconcile the fact that the equity capital position is not an interest paying liability in the context of contributing to an identified “net interest margin”. Then the question becomes how that equity capital position factors into those reported interest margins that you see for each of Canada and the US. And it’s very hard to know how they do that.

So I don’t know how the bank is defining / constructing it’s US dollar net interest margin numbers – but you can be sure that there is no actual margin benefit from an actual US dollar denominated equity capital position with zero interest cost, because that doesn’t exist.

“Potentially dumb question: wouldn't they allocate some of the equity capital to the US side? And so wouldn't the US book also be partly funded at a cost of zero interest?”

DeleteSmart question I think.

An overlay of internal transfer pricing on the actual balance sheet and income statement would include an “imputed” cost of equity capital calculation along with required capital funding – for Canadian and US businesses. This system underpins the determination of criteria for investment across the bank. And it’s where an externally viewed zero interest cost of capital gets assigned an internally employed “hurdle” ROE cost of capital rate.

So there’s definitely a notional, internal allocation of equity capital through such a system, but this is separate from the underbelly of the bank’s actual interest margins by currency and how zero interest cost Canadian dollar equity capital factors into that.

Good points.

DeleteSo I'll grant you that it's possible that BMO's NIMs might not be entirely comparable thanks to equity funding costs. But wouldn't the FRED chart capture those differences? It presumably measures US banks and their US equity funding costs vs Canadian banks and their Canadian equity funding costs.