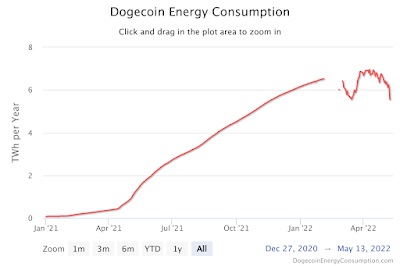

Dogecoin is currently using as much electricity as the entire state of Vermont, home to 620,000 people, tens of thousands of businesses, hundreds of schools and dozens of hospitals.

This constitutes a tragedy. Here's why.

Dogecoin

is a dog-themed cryptocurrency that was introduced in 2013 as a joke.

The total quantity of Dogecoins has jumped to $80 billion in value by 2021, although it has since fallen

back to $15 billion.

Dogecoin functions primarily as a

gambling tool. If people get the timing of their Doge purchases right, they can make

life-changing profits in a very short period of time, no leverage

required. There are also certain cultural and aesthetic reasons for

holding Dogecoins. It's a meme. An icon. For long-time crypto veterans,

Doge is a badge of their insiderness. It shows that they're in on the joke.

But why does it cost a Vermont's-worth of electricity – currently 5.5 terawatt-hours – to produce the Doge gambling experience and assorted Doge cultural material? After all, Vegas casinos provide far more of this sort of entertainment... at a fraction of Doge's total electricity cost.

What I'd suggest is happening here is a type of market failure. Doge is hugely expensive to run. (That's because it uses an energy intensive security method called proof-of-work, which you can read about here). But the casual gamblers and pop cultural aficionados who gravitate to Doge doesn't absorb any of Doge's costs. That is, they don't feel the expenses incurred to run the system. And so they over-gamble on Doge and overindulge on Doge memes. Put differently, the market is accidentally overproducing Dogecoin services.

Dogecoin owners don't feel the painful costs of running Doge because of mining rewards. Each minute, 10,000 new Dogecoins are created out of thin air and paid out to the agents (known as miners) that secure the Doge network.

These mining rewards don't come out of a Doge owner's personal wallet. So if you own some Doge, you never directly experience the costs of running the Doge system. Courtesy of the reward system, you're shielded. Both your Doge gambling habit and your imbibing of the Doge cultural experience are subsidized.

If a casino were to suck up Doge levels of electricity, customers would immediately feel these costs. The nightly rate for a hotel room would be epic, the vig would be huge, and it'd cost $10,000 to go see Celine Dion. This very expensive casino would rapidly go bankrupt.

But not Dogecoin. By using mining rewards to pay for electricity, Dogecoin escapes the casino's fate.

You'd think that Dogecoin owners might at least feel the pain of 10,000 new Dogecoins being created every minute to pay for electricity costs. After all, the miners who receive this reward need to sell those coins to meet expenses like salary and utility bills. Their continual selling should put pressure on Doge's price, and this constant pressure would hurt Doge owners, sort of like a casino room bill.

Not so. The entire stream of 10,000 Doge rewards is known ahead of time. The market therefore factors all future mining-related sales into Doge's current price. So if you own some Dogecoin you never experience anything akin to "sell pressure." It's already priced in. You get to consume Dogecoin as-if it was free.

And that's why Dogecoin constitutes a tragedy. Doge burns up Vermont-levels of electricity because, unlike a regular casino, there is nothing to stop it from doing so. Without a natural cost brake, users consume as much Dogecoin services as they want. If Doge owners did have to bear the true costs of Doge security, they'd quickly find a cheaper venue to gamble, and a thriftier source for meme culture. A Vermont's-worth of electricity would be saved.

The exact people receiving Dogecoin mining rewards are in fact using metered, charged, paid-for electricity.

ReplyDeleteSo except in cases where they're stealing from some inattentive bill-payer, aren't the people consuming the resources facing exactly the (market-influenced, regulated, taxed) cost of those resources?

If that cost somehow doesn't reflect the true social costs of that electricity, isn't the better, sufficient fix to update that price, so that people will only pay it if they are enjoying benefits – which include the fuzzy/affiliative/gambling benefits you outline – in excess of the cost?

It turns out that, if you raise the cost of electricity to accurately reflect the social costs of generating that electricity, you raise it alike for the people creating gambling tokens and for the people heating up their homes.

DeleteIn other words, the cost of electricity doesn't just need to account for the social costs of generating that electricity, it also needs to allow for the social benefits of using that electricity.

This is why electricity production is often subsidized, because the broader society, and the economy that both enables and is enabled by said society, indirectly benefits from people not freezing to death in between their work shifts.

It remains to be seen whether there is any benefit at all, for society or for the economy, to be gained from cryptocurrencies, be it Dogecoin or others, which are otherwise on their way to becoming the grossest misallocation of resources and capital in human history.

PS: Note that, since electricity production is often subsidized, miners are, by definition, stealing not just from some inattentive bill-payer, but from every single one of them. They are taking a good that is subsidized for the betterment of society and redirecting it towards the creation of tokens that provide nothing but profit for their own pockets.

DeleteHi Gordon,

DeleteI agree with you that Doge miners are facing the true cost of resources. They are using metered and taxed electricity, as you suggest.

My critique is leveled at the consumer level of the Dogecoin system. It's the Doge users who aren't facing those costs. As consumers, they hire the miners to run the system. But the strange way that they get to pay the miners (through periodic mining rewards, the price of which is discounted into Doge's price) means that they are effectively shielded from the costs that suppliers would normally impose on consumers.

In short, I'm suggesting that the miners' taxed and metered electricity costs never gets passed on to the final speculator. That's the failure.

Does that make sense?

You're not going to successfully get people to voluntarily swap over to PoS over PoW coins, because they don't really feel any of the costs as you've said. PoS also has pretty significant disadvantages in terms of security, Solana for example has had multiple crippling security failures that had to be bailed out by whales. Its just not a stable model unless ownership of coins consolidates enough for there to be de facto centralization.

DeleteIf you want to reduce the amount of commercial activity that goes into this, impose taxes on the energy consumption of large scale mining operations and tax at the point of conversion from fiat to PoW crypto and vice versa. Many regulators however just seem to see a shiny new technology that for whatever reason spits out gobs of money though, and are hesitant to touch it.

Roths,

DeleteI was surprised to learn a while back that Dogecoin developers have made a commitment to switch to PoS but in light of Ethereum's glacial switch, I'm skeptical.

I agree that imposing a tax may be the best option. I'm not sure how effective a tax on miners would be in reducing Dogecoin's power consumption given that the effect of taxes doesn't get passed on to users. That's why (for now at least) I prefer some sort of tax on users, say like the conversion tax you mention.

Admittedly a localized tax on mining activity would likely result in miners relocating away from a country to another location with cheaper power. But at least within the jurisdiction where the mining tax were to be imposed, there would still significantly reduced power consumption. If enough governments around the world were to impose such taxes it'd ultimately represent a significant constraint internationally on cryptocurrency power consumption. There's only so much cheap power more crypto friendly locations could provide.

Delete